- Buy a Home

- Refinance

-

Loan Options

-

Resources

- Find a Loan Officer

-

About Us

- Login

Are you looking to take the next big step in homeownership? Whether you're looking to sell or refinance your home, you've come to the right place. Our guides, calculators, worksheets, and other resources will prepare you for the road ahead.

Selling your home can be an overwhelming task for even the most prepared seller, so we’ve put together this Homeseller’s Guide to help you best prepare your house, and yourself, for the sale. You’ll learn which updates add value, why you need a Realtor, how to negotiate with buyers, tips for staging and showing your home, and more.

Is refinancing right for you? This guide offers an in-depth look at what to consider when looking into a refinance, and how it can impact your loan in the long run. We will cover all the commonly asked questions relating to refinancing, how to create a strategy for your loan, and step by step instructions on the loan process.

Use our calculator below to find an estimated monthly mortgage payment that works for you. Please remember the dollar amounts displayed are not guaranteed, and what you actually pay may be different. These estimates are for educational purposes only.

Check out these worksheets we’ve created for you to plan for the next big step in homeownership. Find out what repairs you need to make for FHA approval, stage your home room by room, and discover whether you’re truly ready for a refinance.

Yes, it is a benefit if home shoppers are pre-approved. There may be some buyers that aren't pre-approved that are more than qualified to buy your home though, so cutting non-preapproved buyers may limit the amount of people to look at your home. This is a personal decision and your agent can help you decide what to do.

With a fixed rate mortgage the principal and interest portion of your mortgage will not change. If your house payment includes your real estate taxes and homeowners insurance, the payment can change based on these charges. Adjustable Rate Mortgages (ARM) will fluctuate per a schedule for the life of the loan.

Refinancing depends on your unique situation as it compares to the constantly changing mortgage market. People refinance their homes for many reasons - lower their interest rate, lower their payment, take cash-out to do home improvements or consolidate debt, or change loan programs to remove mortgage insurance.

No, this would be called a "prepayment penalty" and none of Ruoff’s loans have this stipulation. You may run into this penalty with other lenders, however.

A third party is responsible for holding the pending transaction funds between the seller and the borrower until the contract is complete. These funds are referred to as "being in escrow". This way, the buyers and sellers can get their money back if they wish to pull out of the contract.

The status of the economy directly results the real estate market conditions. These conditions refer to the supply and demand of the real estate market. Typically, an abundance of homes for sale is considered a buyer's market, while the opposite is true for a seller's market.

If two or more buyers wish to purchase the same property, they can all put in an offer. This is called a multiple offer. The seller can then choose to accept the highest bid, or even ask for the potential buyers to bid for the property with their best offer. This often results in a bidding war.

Refinancing is the process of replacing one loan with another for the same property. For instance, to lower your monthly payment, you can refinance your home by taking out another 30 year mortgage and using that to pay off your initial loan. This way, you have more time to pay off your loan, so your monthly payment lower. There are many reason to refinance from lowering your payment, to getting cash out of your home, or getting a better interest rate.

If a lender knows that a homeowner is no longer able to make payments on their property, they may put the property up for sale in a transaction called a short sale. The property sells for much less than it is worth, but the homeowner is not penalized like they would be if forced into a bankruptcy or property foreclosure.

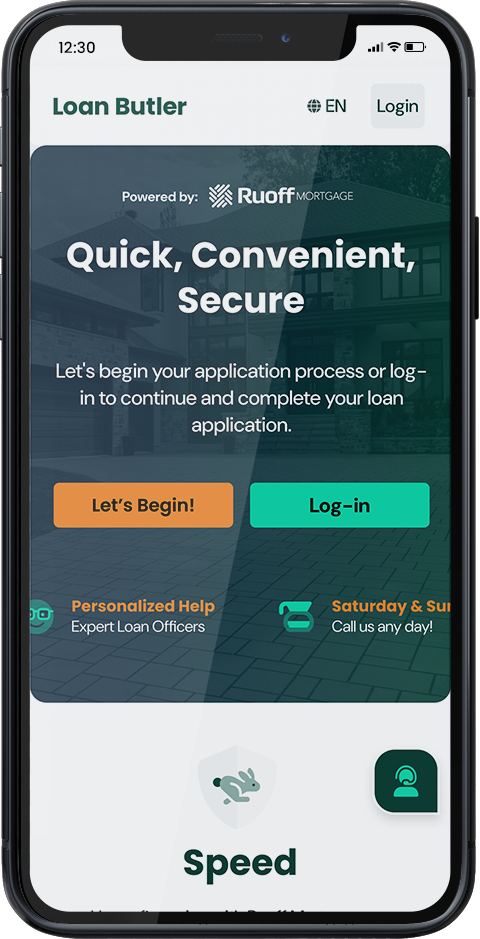

The Loan Butler App was created to provide you with a fast and convenient user experience with Ruoff Mortgage. Get the freedom and the power to move your mortgage process along at a rapid pace! The App can easily provide loan information and status including sending push notification reminders in real time when an important milestone is reached (underwriting approval, clear to close, etc.). The app allows consumers the ability to secure loan documentation and allows all parties on the transaction to keep track of the loan's progress.